Here’s how this transaction would look for cash basis and accrual basis accounting. If you’re not paying employees and don’t want to be tasked with tracking accounts payable and accounts receivable balances, the cash accounting method may be for you. Your business size can be the determining factor in deciding which accounting method to use. Sole proprietors and freelancers almost always decide in favor of the cash basis accountant job description because it’s simple and more accurately tracks cash flow. Using accrual accounting provides a much more accurate summary of your business. The downside is that you will need to pay taxes on your net sales, prior to receiving a payment from your customers, which can be an issue for small businesses operating on limited cash flow.

The key difference between the two methods is the timing in which the transaction is recorded. Whichever way you choose, the accounting method you use will govern your books for a good long while—so make sure you choose wisely. If you’re searching for accounting software that’s user-friendly, full of smart features, and scales with your business, Quickbooks is a great option. Here’s a breakdown of each accounting method’s unique pros and cons, as well as who each method is best for. Our partners cannot pay us to guarantee favorable reviews of their products or services. You also won’t have to worry about creating and posting journal entries, and you’ll only have to pay taxes on revenue that has already been received.

Cash basis or accrual basis: which should you choose?

On the other hand, accrual accounting gives a more complete view of a company’s financial position and is appropriate for businesses seeking loans, investments, or needing to comply with industry regulations. Whether you’re using cash basis or accrual basis accounting, the best way to keep track of your revenues and expenses and eliminate the need to process closing entries manually is to use accounting software. Cash and accrual basis accounting are similar, but vary in how they report revenue and expenses. Whether you use cash basis or accrual basis accounting, you will need to follow the rules that govern the method chosen. The cash basis of accounting recognizes revenues when cash is received, and expenses when they are paid. Unlike the cash method, the accrual method records revenue when a product or service is delivered to a customer with the expectation that money will be paid in the future.

Cash Basis vs. Accrual Basis: What’s the Difference?

- In summary, modern accounting software and tools such as QuickBooks and FreshBooks have simplified the process of implementing cash and accrual accounting methods.

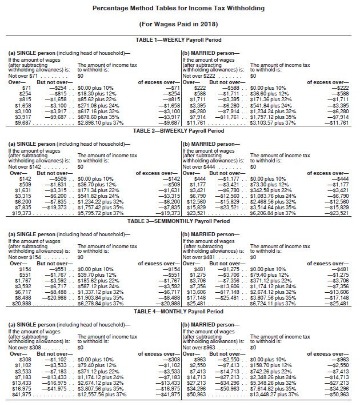

- You might even owe taxes on income you haven’t received yet, so careful planning is critical to covering your tax bill.

- You also had to recognize both the supplies expense and the rent expense in December because that’s when both were paid.

- Whereas with the accrual basis accounting, the company recognizes the purchase in March, when it received the supplier invoice.

Understanding the key differences between cash and accrual accounting, as well as their impact on financial statements and tax implications, helps businesses select the right method. This ensures an efficient financial management system that aligns with the business model and complies with both industry and tax requirements. The accrual accounting method is more complex than cash basis accounting, making it a much better fit for businesses with an experienced bookkeeper on staff. In accrual accounting, revenues and expenses are recorded when they are earned, regardless of when the money is actually received or paid. Accrual accounting is the most accurate way to get a full overview of your business’s balance sheet. Since you record income and expenses at the time of transaction, you have a better understanding of your real financial acquisitions state even if the money has not yet moved to or from your accounts.

Which Is Best for Your Business?

Accrual basis accounting is typically preferred in situations where a business has complex operations, sells products or services on credit, or needs to provide financial statements to stakeholders. Accrual accounting provides a clearer representation of a company’s profit and financial performance. This method records revenues and expenses when they are earned or incurred, rather than when cash is received or paid. In turn, this allows for better insight into the company’s cash flow and operations. In summary, modern accounting software and tools such as QuickBooks and FreshBooks have simplified the process of implementing cash and accrual accounting methods.

If a customer delays payment or attempts to default, your budget will have to shift to account for a failure to pay. When you know how much money will be coming in or going out, you can prepare better and create a clearer budget. This also helps you analyze your income and expenses, which can provide investors with a more accurate picture of the financial health of your business. The other advantage of cash accounting is that it provides a real-time picture of your available cash.

Cash accounting occurs when revenue and expenses are stated at the time money changes hands. Accrual accounting, however, occurs when the revenue and expenses filing tax form 1099 are incurred—which is significantly different. Cash accounting offers a picture of the business at one particular point in time. Accrual accounting offers a better picture of the financial health of the business over a period of time.

Cons of Accrual Accounting

The balance sheet, on the other hand, has accounts like accrued liabilities or accrued payroll, which are also sensitive to the accounting method chosen. The statement of cash flows is affected by your choice of accounting method since net income will differ depending on the method chosen. For the accrual basis accounting method example, if a company purchases a piece of equipment in May, they may not approve the payment until the equipment is delivered in June. However, accrual accounting will still record revenue for May since that is when the purchase took place. In addition to accounting software like QuickBooks and FreshBooks, businesses need to maintain a ledger to record financial transactions. Modern accounting software automatically creates ledgers for businesses, saving time and reducing the risk of errors.